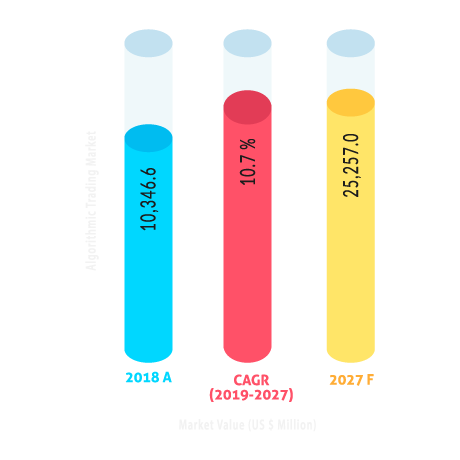

The global automated trading market was estimated to be worth US$ 10,346.6 million in 2018 and is expected to grow at a CAGR of 10.7 percent to US$ 25,257.0 million by 2027.

Figure 1: Automated Trading Market Value( US $ Million )

Automated trading, also known as electronic trading, or black-box trading is a technical development in the stock market. It is a computer-programmed mechanism that follows a complex series of instructions for putting a transaction in order to produce revenue at a speed and frequency that human traders cannot match. Automated trading is gaining popularity as a useful tool for capital markets and has been accepted in countries such as the United States, India, the United Kingdom, and South Korea. The accuracy, exceptional speed, and liquidity of automated trading are distinguishing characteristics that are expected to drive substantial growth in the automated trading market in the coming years.

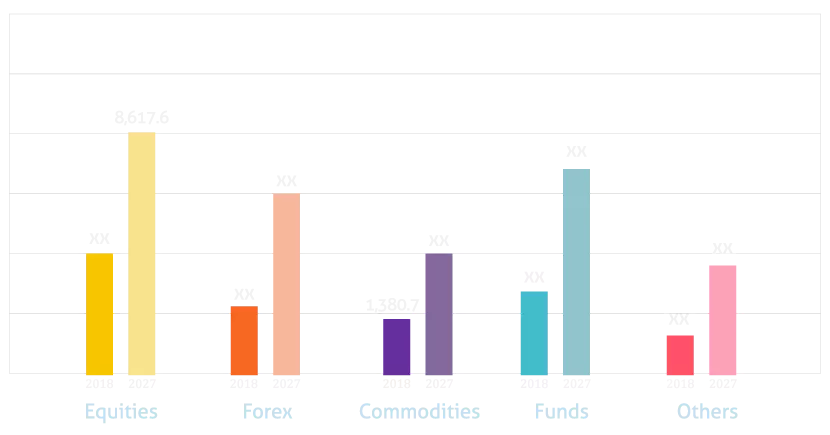

Figure 2: Global Napping Pods Market Value (US $ Mn) Analysis and Forecast, by Application, 2017 & 2027

During the forecast period, the global automated trading market is predicted to expand significantly (2019-2027). This is due to the growing use of cloud-based solutions, services, and cloud analytics for automated trading. Cloud platforms are used by traders for backtesting, trading tactics, and run-time sequence analysis when operating trading activities. Traders choose cloud computing because it is expensive to construct one's own data centres for facilities such as data storage, backup and recovery, data processing, and trading networks. As a result, renting space on the cloud is more convenient than building applications or hardware resources. Since it is costly to develop one's own data centres for facilities such as data collection, backup and recovery, data processing, and trading networks, traders choose cloud computing. As a result, rather than designing applications or hardware infrastructure, it is simpler to rent space from the cloud. According to Coherent Market Data, the cloud storage market is expected to expand from US$ 58 billion in 2013 to US$ 191 billion by 2020, whereas the technical cloud services market is expected to grow from US$ 15.36 billion in 2017 to US$ 41.59 billion by 2023. As a result, increased acceptance of cloud-based technologies is projected to accelerate growth in the automated trading segment.

The automated trading market is expanding due to rising demand for AI-based services in the financial sector. In automated trading, AI assists in adapting to business dynamics, learning from past events, and making appropriate trade decisions. AI is used by trading firms such as Blackrock, Renaissance Technologies, and Two Sigma, among others, to pick stocks. According to Coherent Market Insights, approximately 37% of Indian financial institutions invested in artificial intelligence-focused technology in 2018, with approximately 68 percent planning to accept in the near future. As a result, AI adoption in the financial sector is projected to increase progress in the automated trading industry over the forecast period. Besides that, non-equity investment is becoming more popular.

Furthermore, the disposable income has resulted in increased trading volume, which is a major factor behind the development of the automated trading sector. According to the India Brand Equity Foundation, India's overall rural income was around US$ 572 billion in 2018 it is expected to cross US$ 1.8 trillion by 2021. The rural per capita disposable income in India is predicted at CAGR of 4.4% to US$ 631 by 2020. Moreover, according to DATA USA, the United States had 326 million of people in 2017, with an average age of 38.1 and a median family income of US$ 60,336. Between 2016 and 2017, the US population has increased by 0.802 percent, from 323 million to 326 million, and the median household income increased by US$ 57,617 to US$ 60,336. (a 4.72 percent increase).

-

The global automated trading industry is divided into five applications:

- Foreign Exchange

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Others

In 2018, the equities segment accounted for the greatest share, as it is one of the leading asset categories for exchanging trading shares in a stable, regulated, and managed environment. An equity market, also known as a capital market or a share market, is a market in which shares of firms or institutions are sold and exchanged, either on stocks or by dealers or brokers. The 'Stock Exchange' is the location where stocks in an equity market are traded. In India, for example, equity shares are traded on two stock exchanges: The National Stock Exchange of India (NSE) and The Bombay Stock Exchange (BSE). Automated trading in equity is used to conduct an overall market order by using automatic pre-programmed trading directions that account for variables such as cost, time, and volume. In equities, automated trading is simply a method of minimizing expense, market effect, and risk in order execution.

On the basis of region, the automated trading market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Because of technical advances and increased use of automated trading by different end-users such as banks and financial institutions in the region, the North America automated trading industry contributed the largest market share in 2018. According to SelectUSA, the United States' stock markets are the biggest and most liquid in the world. In 2017, the finance and insurance sector in the United States contributed to 7.5 percent (or US$1.45 trillion) of the country's GDP. BMO Capital Markets, BMO Financial Group's investment and corporate banking arm, reported a multi-year constructive partnership with Clearpool Group, a developer of innovative electronic trading technologies, in April 2018. Clearpool will provide BMO with a fully customizable automated management system (AMS) infrastructure to perform Canada equities for BMO's institutional clients under this arrangement. Furthermore, several North American automated trading solution providers are focusing on integrating Artificial Intelligence (AI) and Machine Learning (ML) functionalities with their current automated trading systems. For context, in May 2018, Bloomberg announced the introduction of the new AI-powered price forecasting application for investment professionals. The ‘Alpaca Forecast AI Prediction Matrix' is an application (app) that forecasts short-term market prices for major markets such as EUR/USD, AUD/JPY, USD/JPY, CME Nikkei 225 Futures Index, and US 10-year treasury bonds using Bloomberg's Market Data Feed (B-PIPE). Over the projected period, such factors are expected to help in the development of the automated trading industry in North America.

Furthermore, the Securities and Exchange Commission (SEC) of the United States adopted in April 2016 a regulation introduced by the Financial Industry Regulatory Authority (FINRA) to reduce market manipulation that allows automated trading developers to register as security traders.