In few days, Gold sharply fell by 4%. So, is it a good time to buy Gold?

Key factors That Influence Gold Prices

- Federal Monetary Policy

- Federal Future Announcements

- World Economic Data

- Supply and Demand

- Inflation

- Currency Movement

- Uncertainty

- ETFs

The annual inflation rate for the United States has been 5.0% for the past 12 months; this ended May 2021 after rising 4.2% previously.

When inflation increases, investors move to a secure investment like Gold, classified as a “safe-haven”. They do this to avoid uncertainty. An increase in Gold investment triggered price rising from march 2021 and reached $1900 per ounce considering high inflation and fed policy uncertainty.

Federal Reserve officials left policy unchanged on 16th June, 2021 Wednesday. However, they moved up expectations for two interest rate increases by the end of 2023, triggering some panic selling in the precious metals markets.

If you are a long-term investor and can hold your open positions, you could buy Gold now and in every dip. However, technical analysis, pivot support, and resistance can give short-to-medium-term indications of when to buy.

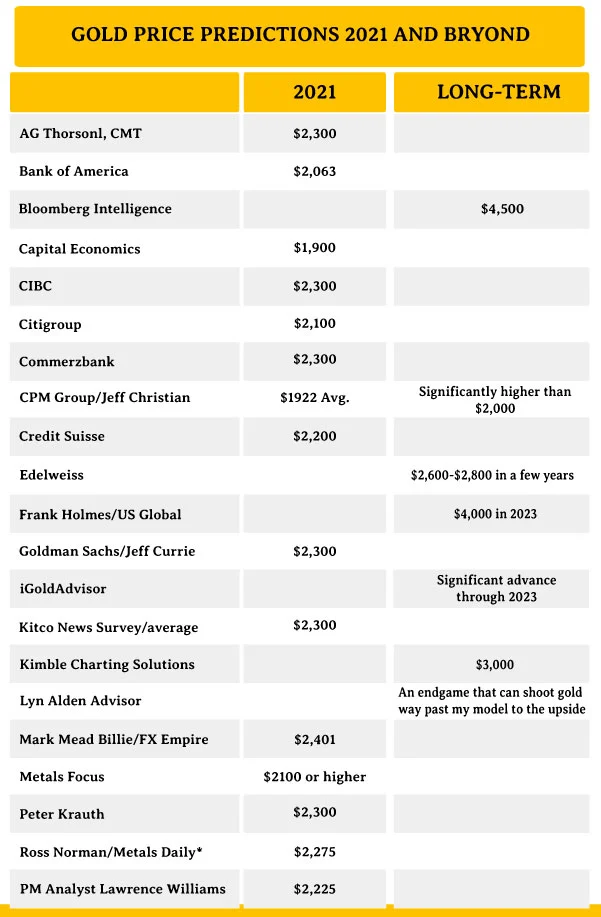

If we look at the history of 100 years, gold price rose during and after every recession to hedge against inflations and market fear. We, evol trader, see the gold price at $2000 in the year 2021.

We may see volatility or a further downtrend for the shorter period, so be cautious if you are trading in a shorter span or would like to hold the position for a few hours, days or weeks.

If we consider the last 50 years, inflation significantly contributes to increasing gold price. For example, whenever inflation was 5% or more, we have seen a 16% gain in Gold every year.

We Evol Trader provides a fully automated trading system for forex, commodity and Indices. Our advanced system is designed to make the most profitable trades.